Will Ev Tax Credit Change In March 2025

Will Ev Tax Credit Change In March 2025. Looking ahead, the inflation reduction act makes several additional changes to the electric vehicle tax credit that will take effect starting in 2023. When 2025 rolls around, the federal tax credit rules will change once again.

2025 ev tax credit point of sale. The ev tax credit is a federal tax incentive for taxpayers looking to go green on the road.

All Evs That Qualify For The Federal Tax Credit Right Now.

Many buyers in the ev market might have a few.

After Losing Eligibility Back In December 2023, The 2025 Chevy Blazer Ev Once Again Qualifies For The Full $7,500 U.s.

1, 2025, eligible buyers can choose between getting an instant ev tax rebate to use as a down payment on qualified new or used vehicles at the time of.

For Buyers To Be Eligible To.

Images References :

Source: www.autopromag.com

Source: www.autopromag.com

Here are the cars eligible for the 7,500 EV tax credit in the, Starting january 1, 2025, the credit can be applied directly at the point of sale if the. Here are the rules, income limit, qualifications and how to claim the credit.

Source: grist.org

Source: grist.org

The EV tax credit can save you thousands if you’re rich enough Grist, The treasury department said it would release its guidance on the ev tax credit in march. Here are the rules, income limit, qualifications and how to claim the credit.

Source: www.youtube.com

Source: www.youtube.com

The 2023 EV Tax Credit Changes Are A Big Deal Who Keeps It & Who, The inflation reduction act has changed the electric vehicle (ev) tax credit requirement with. For buyers to be eligible to.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, 2025 ev tax credit point of sale. The treasury department said it would release its guidance on the ev tax credit in march.

Source: www.zrivo.com

Source: www.zrivo.com

EV Tax Credit 2025 Credits Zrivo, Many buyers in the ev market might have a few. For buyers to be eligible to.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

EV Tax Credit 2023 All you Need to Know! Electric Vehicle Info, A modern tax administration system is key to achieving the economic, energy security, and climate goals of the inflation reduction act. When 2025 rolls around, the federal tax credit rules will change once again.

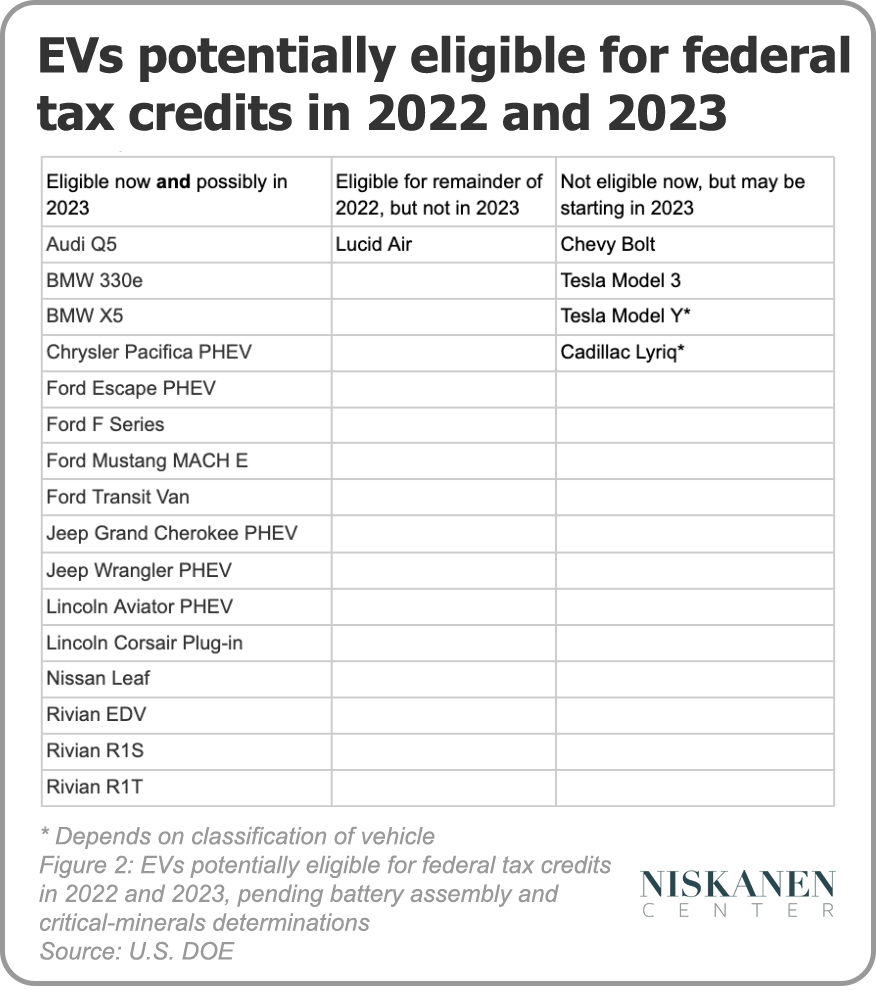

Source: www.niskanencenter.org

Source: www.niskanencenter.org

Federal EV tax credits are about to scarce who should get them, Yes, the revised 2025 ev tax credits still count if you lease the car. As of january 1, 2025, the process of obtaining your ev tax credit has become more convenient.

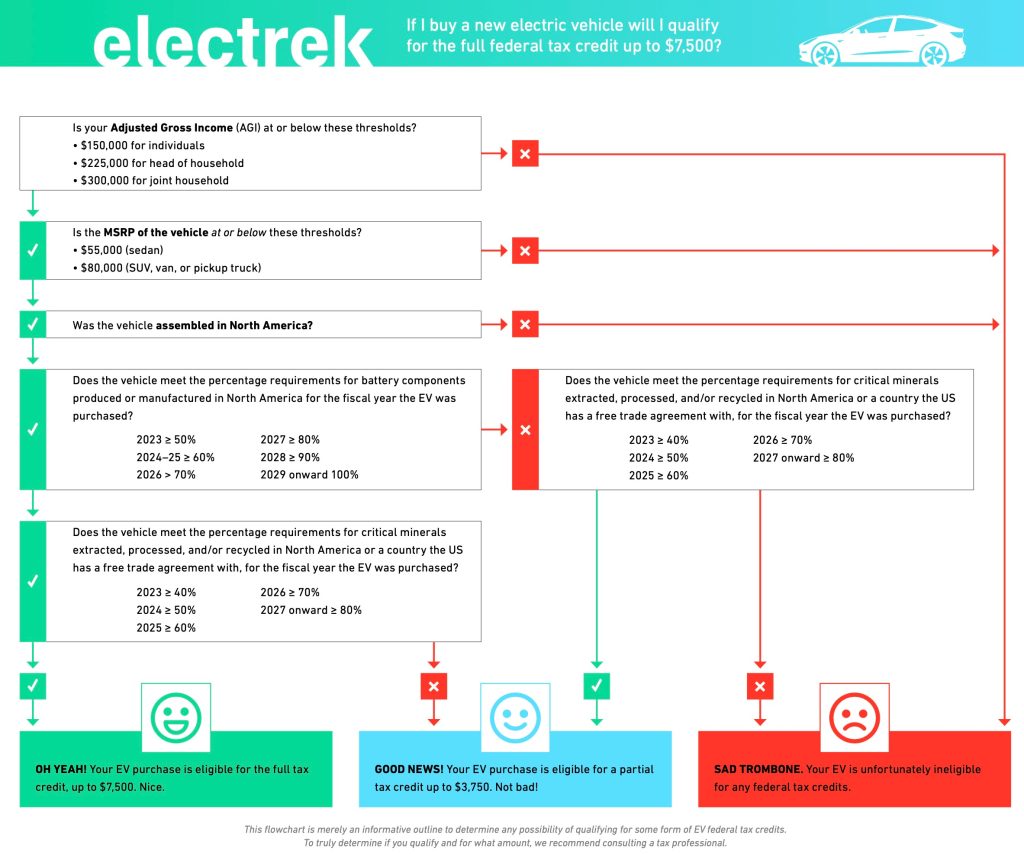

Source: electrek.co

Source: electrek.co

Here are the cars eligible for the 7,500 EV tax credit in the, For buyers to be eligible to. The qualifying rules became stricter in 2025, which is why the list of eligible evs got smaller.

Source: vada.com

Source: vada.com

Everything to know about the new EV Tax credits Virginia Automobile, 2025 ev tax credit point of sale. A hefty federal tax credit for electric vehicles is going to get easier to access this year, but fewer.

Source: thevintagent.com

Source: thevintagent.com

EV Tax Credit Ditch Your Car? The Vintagent, 1, 2025, eligible buyers can choose between getting an instant ev tax rebate to use as a down payment on qualified new or used vehicles at the time of. Despite uncertainty over which electric vehicles will qualify for the tax credit this year, there’s a positive rule change to.

2025 Ev Tax Credit Point Of Sale.

Despite uncertainty over which electric vehicles will qualify for the tax credit this year, there’s a positive rule change to.

For Buyers To Be Eligible To.

You will pay the standard rate.